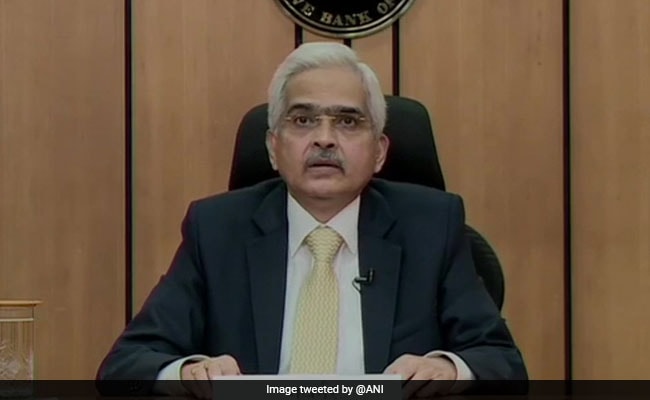

RBI Governor’s Address: Address by RBI Governor Shaktikanta Das to the media.

New Delhi:

In the second wave of Covid-19, Reserve Bank of India (RBI) Governor Shaktikanta Das addressed the media on Wednesday and made several announcements aimed at bringing relief to the economy. He said that the second wave of Corona is being seen in the country. In such a situation, the country will have to raise its resources anew. He said that the country will have to move forward with efforts to overcome this crisis of Corona.

Also read

– The RBI Governor said that detailed and swift steps need to be taken to stop the spread of Corona and the Central Bank is keeping an eye on the rapidly changing situation. He said that RBI does not think that there will be any more deviation due to this wave in the growth estimate of April 2021.

– To increase the availability of funds for medical services, the RBI has decided to provide a term liquid facility of Rs 50,000 crore. Banks can lend more to the medical services sectors by 31 March 2022. To ensure emergency health security, this scheme of 50,000 crore term liquidity facility has been brought at the repo rate, under which banks will be able to help medical institutions such as vaccine manufacturing companies, hospitals and patients at this time.

Regarding the business affected by Corona, he said that businesses are learning to work with localized and cantonment steps and the construction process has had little impact. Consumer demand also remains. He said that due to the forecast of normal monsoon, rural demand is expected to remain.

– Das said that the RBI has prepared Resolution Framework 2.0 to reduce the pressure on the most affected small borrowers (MSMEs and individuals) in this situation. He informed that provision of loans and incentives will be made soon in priority sectors. Apart from this, there is a plan to make Kovid Bank loan.

These RBI announcements have come when the country is struggling badly with the second wave of Kovid. Let us know that on Monday, the Center for Monitoring Indian Economy (CMIE) had reported that due to the second wave of Kovid in the country, about 75 lakh people have lost their jobs and this has caused the unemployment rate to reach a four-month high of 8 percent. Arrived at.