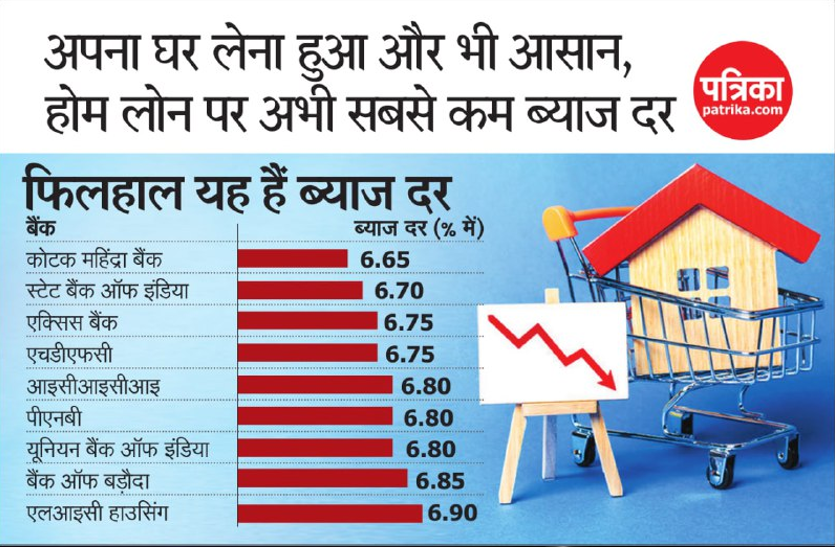

New Delhi . This is a great opportunity for people looking to buy a home. This may not provide a good opportunity for investing in real estate. Actually, at this time you will get a home loan at a cheap interest to buy a house. Home loan rates are currently at a 15-year low. Home loan interest rates have reached where it is difficult to ignore them. Kotak Mahindra Bank has also cut its home loan rates by 6.65 per cent after the State Bank of India (SBI) cut its base rate by 10 basis points. After these, HDFC has taken a step of giving great relief to its customers. The bank has cut the interest rate on home loans by 5 basis points or 0.05 percent for its customers.

Kotak Mahindra Bank Home Loan –

Kotak Mahindra Bank is offering home loan at 6.65%. This offer is till 31 March. This will apply to all new and old loans. This includes both salaried and business customers.

SBI Home Loan –

On March 1, SBI announced a discount of up to 70 basis points on home loan interest rate to customers under its special offer. Under this offer, home loan interest rates will start from 6.70 per cent, which is the record low so far. However, this offer will be based on the customer’s CIBIL score and the loan amount. Apart from this, SBI has also completely waived the processing fee on the home loan till 31 March.

Before a home loan, keep these things in mind –

Before a home loan, take into account how much the income is and how much the banks can lend accordingly.

Your ability to take a home loan depends on the capacity to repay it. It depends on your monthly income, expenses and other family income, assets, liabilities, stability in income.

Banks first check whether you will be able to repay the home loan on time. The more money you get in your hands every month, the more your home loan amount will increase. Usually, a bank or lending company looks at whether you will be able to give 50% of the monthly income as a home loan installment. The loan amount also depends on the term and interest rate of the home loan. Apart from this, banks also set an upper age limit for home loans.

Keep these things in mind –

Correct calculation of interest

Complete information of terms and conditions

Knowledge of old loan terms and conditions

Considering the interest rate benchmark

Transfer time

Down payment

Loans up to 80-90% of the property’s value

One has to make a down payment of 10-20% of the price of a house or flat. This is your own contribution. After this, loans up to 80-90% of the value of the property are available. It also includes charges like registration, transfer and stamp duty. Even if the lending unit approves a large amount of you as a home loan, it is not necessary that you take the entire amount as a loan. While purchasing the property, you should make maximum down payment, so that the loan burden is minimized. Keep in mind that the bank lending on home loan charges a lot of interest from you in the long term.

Report claims

Interest of women-

According to a report by property consultant company Enrock, more than 70 percent of women said that this is the best time to buy a home. About 66% of the women in it, who want to invest in Affordable Housing. Most women want to buy a home in bedroom, kitchen and hall (BHK) format.

Transfer Way –

You can transfer your loan to a lender offering low interest rate or other benefit. When choosing the option of balance transfer, make sure that you are not making any mistake.